Case Note

~

Hamilton Finley Pty Ltd v Aojia Investment Pty Ltd [2017] VSC 319 (7 June 2017)

Justice Elliott

EXECUTIVE SUMMARY- This case held that where a client of a real estate agent signs a standard form Exclusive Authority, but (by clerical error) only part of the Authority was sent to the client, the remaining pages of the Authority do not apply unless the client could reasonably be expected to be aware of those pages.

- It therefore raises the possibility that an incomplete standard form Authority could incorporate the omitted terms if the client had notice of them.

- It also, usefully, discusses numerous breaches of the Estate Agents Act 1980 (Vic) (and therefore gives interpretative guidance on numerous provisions of that Act) which would bar an agent from suing to recover fees in respect of a particular transaction.

The Exclusive Authority was the 4-page standard form REIV authority. A scanned copy was emailed by HF to A. Due to a scanning error, however, only pages 1 and 3 were scanned, and page 3 only contained a single (not litigated) contractual term, a privacy policy, and some definitions. A executed that 2-page document. Page 1 was marked ‘page 1 of 4’. Page 3 was marked ‘page 3 of 4’. There were a number of other defects in the Authority (described in the outline of Elliott J’s decision, below). The commission would be 2.2% of the sale price, plus 60% of anything over $13.5 million. The omitted page 2 of the standard form included the following term:if at the date the Property is sold, another agent holds an exclusive authority for the sale of the Property and [Aojia] may have to pay the other agent a commission; [Hamilton Finley] cannot claim commission under the terms of this Authority

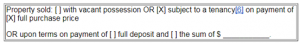

The Vendor agrees to pay the Agent the commission on the terms of this Authority if the Property is sold: 1.1 during the exclusive authority period by the Agent or by any other person (including the Vendor or another agent); or … The commission is due and payable by the Vendor on the Property being sold.‘Sold’ was defined to include entry into a contract of sale. A contract of sale to sell the land for $17M was executed on 31 October 2014, with settlement to occur on 15 September 2015. However, settlement never took place and the full purchase price was never paid. ISSUE The dispute was over whether cl 1.1 was part of the contract. HF argued that it was, because A was on notice that it was signing a standard form contract (given the total page numbers were indicated), so it had notice of the term even though it did not sign a document containing it. A argued that the entirety of the authority was the signed first page. The first page (as sent to A and forming part of the signed document) had a section appearing as follows:

The ‘on payment of full purchase price’ box being ticked meant there was an inconsistency with clause 1.1, ie clause 1.1 required payment upon sale but the ticked box only required payment at settlement.

KEY FINDINGS: CONTRACT

The ‘on payment of full purchase price’ box being ticked meant there was an inconsistency with clause 1.1, ie clause 1.1 required payment upon sale but the ticked box only required payment at settlement.

KEY FINDINGS: CONTRACT

- The words ‘page 1 of 4’ were irrelevant because there was no evidence that they were drawn to the attention of anyone at A, and there were no references on either of the printed pages to the missing pages 2 and 4.

- The other surrounding circumstances, including the lack of experience of A’s directors, and HF’s continual failure to draw attention to the issue, indicated that only the first page comprised the exclusive authority.

- The commission fee was shown as both a percentage of an estimated sale price and a dollar amount, but these were inconsistent. The Court found that this breached s49A(1)(c)(ii) EAAct, as it requires both a dollar amount and percentage of the sale price to be shown.

- The fee is required to be calculated by reference to ‘the reserve price or any other relevant amount’ (s49A(1)(c)(ii) EAAct). Elliott J commented that this likely meant that the fee needed to be calculated by reference to a realistic estimate of the sale price and not an amount that bears no resemblance to the reserve price or estimated sale price. Otherwise, the word ‘relevant’ would be superfluous.

- The agent must give the client a copy of the signed agreement before requesting any fee. HF argued there was no need to comply with this where it had already emailed A the agreement. Elliott J said this was irrelevant, and the agent breached the requirement to give the signed agreement to the client at the required time.

- HF gave no proper estimate of the selling price as required by s47A(2) EAAct. While it included an estimate of $12–13M, it already knew of a buyer willing to buy for $17M. Elliott J noted this, but made no direct ruling.

- HF allegedly failed to inform A that the commission was subject to negotiation as required by s49A(1)(b) EAAct. The Court found that HF did not contravene this provision, as it emailed A that it was happy to discuss fees if A had any concerns; and it never said its fees were not subject to negotiation.

Leave a Reply